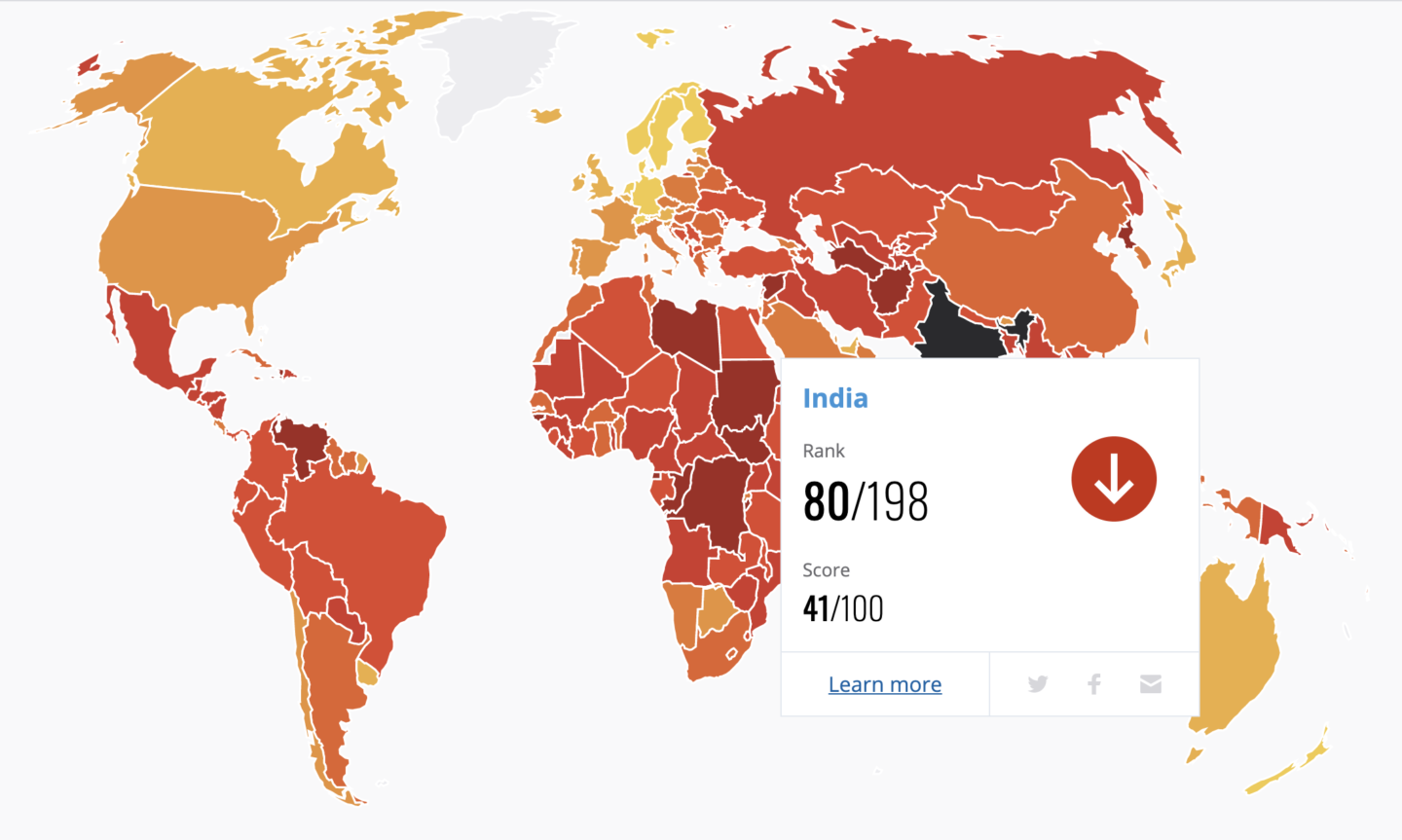

Digital Compliance in India: preparing your international business for new requirements

India is modernizing how companies comply with business regulations by introducing digital systems and automated processes. Instead of relying on paper-based submissions and manual reporting, Indian regulators are requiring companies to use technology platforms for regulatory compliance, reporting, and oversight activities. This shift means international companies operating in India must adapt their compliance systems to meet new digital requirements.

The changes are part of broader regulatory reforms, including the Jan Vishwas 2.0 initiative and new data protection rules. These developments require multinational corporations to reassess their compliance strategies when establishing or expanding operations in India.

Why India is moving toward digital compliance

To understand why India is moving toward digital compliance, it’s important to recognize the scale of the regulatory challenge. In 2024, India’s business regulations changed 9,420 times – that’s an average of 36 changes every single day. For international companies, keeping track of these constant updates manually became practically impossible, leading to confusion and compliance risks.The Indian government has acknowledged this problem and is working to address it. In the 2025 budget, Finance Minister Nirmala Sitharaman announced the Jan Vishwas 2.0 initiative, which will remove criminal penalties for approximately 100 minor business violations. However, this represents a small portion of the total regulatory framework – over 20,000 business rules still carry potential jail time for violations. The government’s solution is to use digital technology to make compliance easier and more predictable for businesses.

Digital Personal Data Protection Rules 2025

One of the most significant developments for international companies is the implementation of the Digital Personal Data Protection Rules 2025. To ensure adherence to the Digital Personal Data Protection Rules, 2025, businesses must take a proactive approach to compliance. The draft rules emphasize accountability and ongoing assessments of data handling practices, ensuring businesses meet both legal and operational expectations.This regulatory framework introduces several key requirements that international companies must address through their digital compliance strategies. Organizations must establish comprehensive policies that align with the DPDPR framework. These should outline internal procedures, employee training, and data protection strategies. Regular updates are critical to address emerging risks or regulatory changes.

Key digital compliance requirements for international companies:

- Implementation of privacy-by-design principles in all IT systems and business processes

- Automated data protection impact assessments for high-risk processing activities

- Digital consent management systems that comply with Indian data localization requirements

- Real-time monitoring and reporting capabilities for data breach incidents

The emphasis on automation and digital processes extends beyond data protection to encompass broader compliance requirements. Companies must invest in technology infrastructure that can adapt to regulatory changes in real-time while maintaining operational efficiency across their global operations.

Jan Vishwas 2.0: decriminalization through digital compliance

The Jan Vishwas 2.0 initiative represents a shift toward trust-based governance enabled by digital technologies. A balanced reform approach—shifting minor infractions to civil penalties, implementing self-declaration mechanisms, and developing a unified digital compliance framework—can streamline regulatory processes while maintaining worker protections.This approach has particular significance for international companies because it reduces the risk of criminal liability for minor compliance violations while establishing clear digital pathways for regulatory engagement. The Jan Vishwas (Amendment of Provisions) Act, 2023 streamlined compliance by decriminalizing minor offenses across economic laws, recognizing that outdated penalties hinder business growth.

Benefits of the digital-first compliance framework:

- Reduced regulatory uncertainty through standardized digital processes

- Enhanced predictability in compliance requirements and penalties

- Streamlined reporting mechanisms that integrate with global compliance systems

- Clear escalation paths for resolving compliance issues without criminal implications

Strategic implementation roadmap

International companies should consider India’s digital compliance changes as part of their operational planning rather than merely a regulatory requirement. A collaborative approach among businesses, regulators, and policymakers will be crucial in refining these rules, fostering innovation while safeguarding privacy.Successful implementation requires a phased approach that begins with assessment of current compliance capabilities, followed by strategic technology investments, and concluding with ongoing monitoring and optimization. Companies that invest early in their digital compliance infrastructure will be better positioned to capitalize on India’s continued economic growth while minimizing regulatory risks.India’s digital compliance developments represent a fundamental shift in how business is conducted in one of the world’s largest and fastest-growing economies. International companies that embrace this transformation through strategic technology investments and proactive compliance management will find themselves well-positioned to succeed in India’s increasingly digital business environment. The key is to view these changes not as obstacles but as opportunities to build more efficient, transparent, and scalable business operations that can serve as models for global expansion.