Setting up a subsidiary in a Special Economic Zone (SEZ) in India or not?

"*" indicates required fields

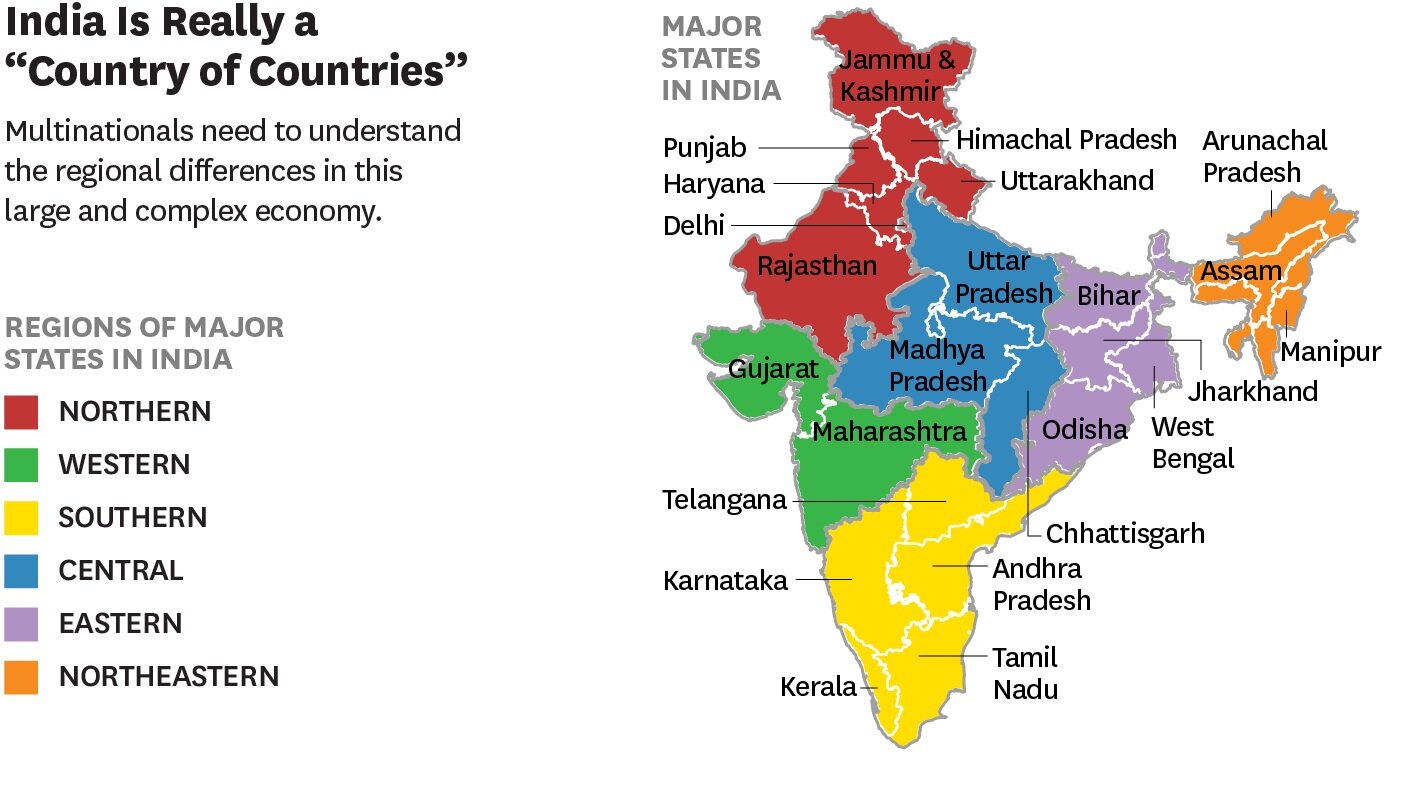

You have decided to open a subsidiary in India, but where will you locate in this vast country? Besides selecting a state and city, you also need to investigate whether a Special Economic Zone (SEZ) in India is an attractive location for your business.

Favorable tax rules

A Special Economic Zone (SEZ) is simply an industrial area where favorable tax rules apply. There are SEZs in all shapes and sizes, such as Free Trade Zones (FTZ), Export Processing Zones (EPZ), Free Zones (FZ), Industrial Estates (IE), Free Ports and Urban Enterprise Zones.

Foreign companies that want to produce in India and export from India can go to an Export Processing Zone (EPZ). SEZs are accessible to both Indian and foreign companies.

No income tax, no GST in a SEZ

If you establish yourself in one of the more than 300 Special Economic Zones (SEZ) in India, you benefit from various advantages. To start with, your company does not pay any income tax for the first five years, and then only on 50% of your income.

Companies in SEZs are also exempt from paying sales tax (GST). In addition, companies established in an SEZ do not have to pay Basic Custom Duty (customs duties, on average 30% in India). Furthermore, companies do not have to pay import duties on the purchase of products and services for the development, operation or maintenance of the company located in an SEZ.

Subsidies

In an SEZ, companies also benefit from various measures by the Indian government to encourage trade promotion, such as the Merchandise Export from India Scheme (MEIS, more than 4,000 items are eligible) and the Service Export from India Scheme (SEIS). In the budget 2023/2024, the Indian government has announced that the direct tax benefits will continue unabated.

Comparison of the tax breaks per trade zone

Is it best to locate in a Special Economic Zone, in an Export Oriented Area or in a Domestic Tariff Area? Below we list the different (tax) advantages per type.

| Transaction | SEZ | Export Oriented Area | Domestic Tariff Area |

| Basic Customs Duty on the import of goods. | Exempt | Exempt | Non-exempt |

| GST on the import of goods. | Exempt | Exempt | Non-exempt |

| Import of services. | Exempt | Exempt (tax refund) | Non-exempt |

| Local procurement of goods | Exempt (0 rate) | Exempt (tax refund) | Non-exempt |

| Local procurement of services | Exempt (0 rate) | Exempt (tax refund) | Non-exempt |

| Income tax exemption under 10AA | 100% exempt for 1st 5 years, 50% exempt for 2nd 5 years. 50% for five years on reinvestment of profits. | NIL | NIL |

| Trade promotion subsidy (SEIS and MEIS). | Scrips value between 3 to 7% of net realized export value. | NIL | NIL |

| Other subsidies for trade promotion. | Yes | Yes | Yes |

Process of setting up a business in a SEZ in India

Setting up a business in a SEZ takes about two months. Here are the steps you need to follow:

- Select a suitable SEZ.

- Draw up a letter of intent with the developer of the SEZ.

- Register online using Form F.

- Prepare a project report and submit it on time. This report should at least include an overview of the expected inputs and outputs for the next five years.

- Online payment of one-time registration and annual maintenance fee.

- Online acceptance of letter of approval with Intimation.

- File Bond-Cum-Legal Undertaking using Form H.

- Update online master file with GSTIN and operations users IDs.